As I speak to my clients, I realized that retirement is on their minds almost every day, especially if they do not like their work and only desire their monthly paychecks. So I decided to focus on helping them plan early for their retirement as my primary goal, so that they can be financially free ASAP.

Our Singapore CPF Board has recently conducted many roadshows to educate the public on the importance of retirement planning. People are more aware how difficult it is to retire comfortably in our expensive Singapore. Most are concerned of not having enough money when they are old.

I have written 4 MOST IMPORTANT ways to ensure you can have a great retirement life ahead!

1. Know exactly how much you want when you retire

Many old people now do not have enough retirement savings and have to continue working. One main reason is that they did not foresee Singapore will become the most expensive city to live in the world! So, in order to prepare ourselves, we need to know how much we want as income, when we stop work.

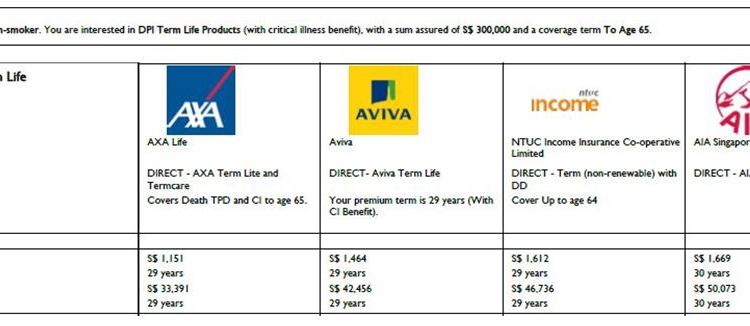

A simple way is to imagine our lifestyle when we stop work at a certain desired age, eg. age 60. How much will you need in today’s dollars every month? After we have a figure, eg. $3,000 (today’s dollars), we need to project it at an inflation rate, to know what is the future income you need. You can use a retirement planning tool to assist you in calculation.

2. Focus on PASSIVE INCOME

Build “taps” of passive income

The total amount of saving and assets you need when you retire may be daunting! Usually it is in the millions! So if you do not have the amount of money, does it mean you cannot retire? Obviously not!

Financial planning in your early years is the key to ensure you have a great retirement future. And you need to focus on PASSIVE income. There are many financial instruments out there which can give a decent rate of passive income. In addition, passive income can also come from your small business, your rental property, or even your children!

Here are some sources of passive income:

– Renting out a room, or a whole apartment

– Buy good dividend paying blue chip stocks

– Our good and trusted CPF Life income for life

– Bonds which give income regularly

– Having a small business, which is run by your trusted general manager, and giving you dividends per month as a shareholder.

– Unit trusts which gives you monthly income or dividends

– Our children?

Be knowledgeable about the passive income options. Start planning early. Start NOW!

3. Stay in an affordable home when young

If you plan to stay in a luxurious condominium when you are young, and spend all your CPFOA savings paying the mortgage, then you will find yourself having very little to retire later. So, it is best you spend at most 15% of your income on your mortgage repayments.

For example, if you are earning $5,000 a month, you should only spend $750 per month on your mortgage repayments. If you take a loan repayment scheme for 30 years and the loan amount is 80% of your home value, your home should only cost $240,000. This is equivalent to a 3 room flat in a non-matured estate, like Sembawang area. If you are a double income family (meaning husband and wife are working), then you can afford a home valued at $480,000 which is a decent 4 room flat in a matured estate, probably Bishan area.

With only 15% of your income financing your home mortgage, you can save up the rest of your CPFOA and cash savings to invest and fund your retirement. If you take time to calculate, you will realize it will be a very substantial sum of retirement sum in the millions!

4. Save 20% of your CASH income

Imagine you are 30 years old and just got married. You earn $5,000 per month and your employer gives you 17% of your income in CPF. You followed my advice and took up an affordable mortgage of 15% your income (using CPFOA).

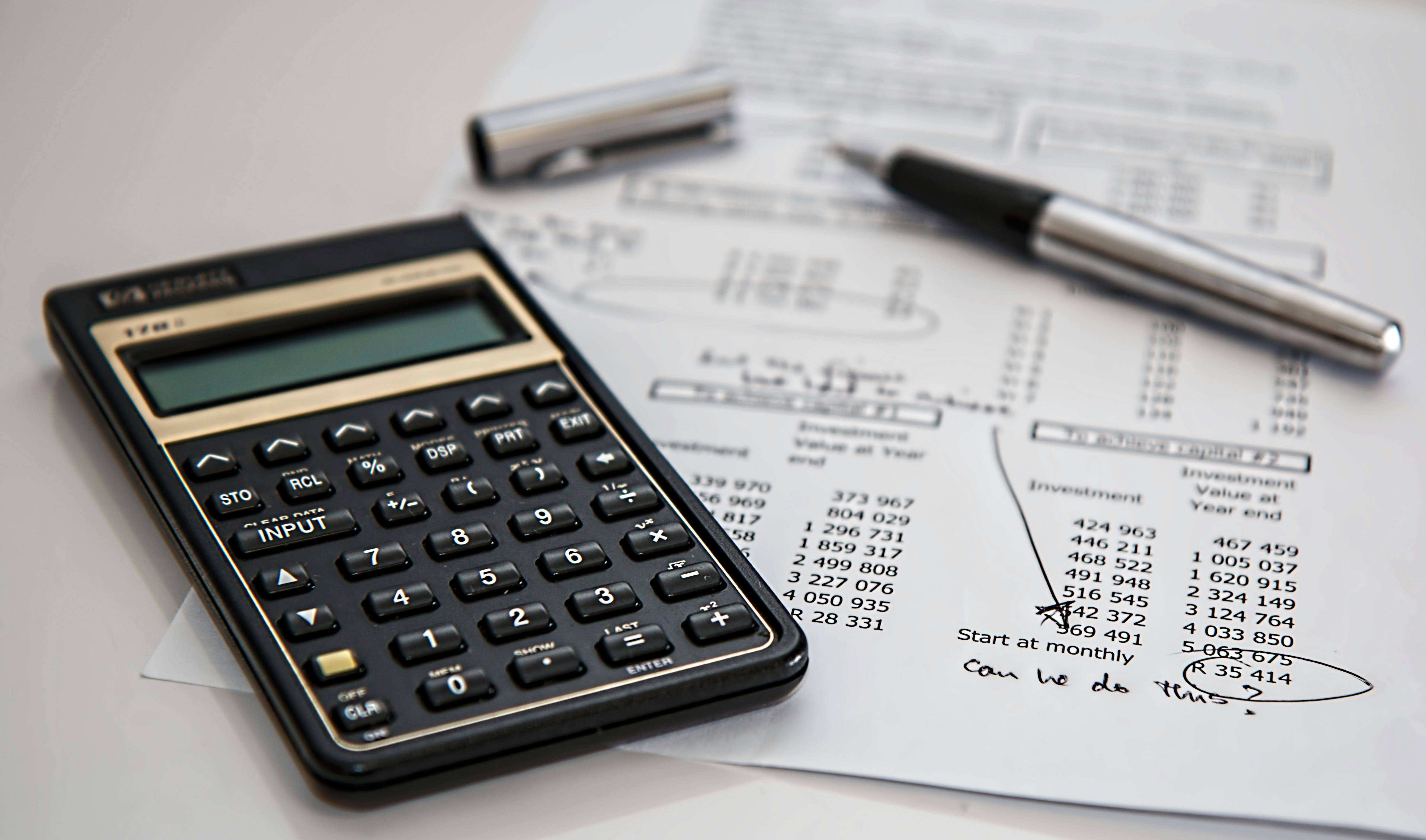

Now, if you continue to save 20% of your income in cash, you will have the following:

CPF savings towards retirement = $1,100 per month

Cash savings towards retirement = $1,000 per month

If you take the total savings and compound it over 30 years at a return of 7%, you will have $2.38 million at age 60! This is more than enough for a very comfortable retirement in Singapore!

Therefore, it is extremely essential that you save not only in CPF, but also 20% of your income in CASH.

If you are in your early 30s and have yet to plan for your retirement in Singapore, it is definitely a good time to start NOW! If you are already in your 40s and still have not started planning, it is extremely urgent that you begin NOW! Time waits for no man, and you will soon realize you are already 60 years old and have to continue working into your golden years.

Take your first step towards planning for your retirement!